Investment Thesis

Zooplus (OTC:ZOPLY) is a European web-based retailer of pet supplies. Since its foundation, Zooplus has grown to become the leader in online pet supplies in Europe. Currently, it has a market share of around 50% in the online pet food industry. The industry is characterized by commodity type of products, therefore the lowest cost provider has the highest probability to win in the long run. From current standpoint valuation is not attractive but if you think Zooplus could achieve its plans and further develop economies of scales than it makes sense to look deeper into Zooplus.

Business and Industry Overview

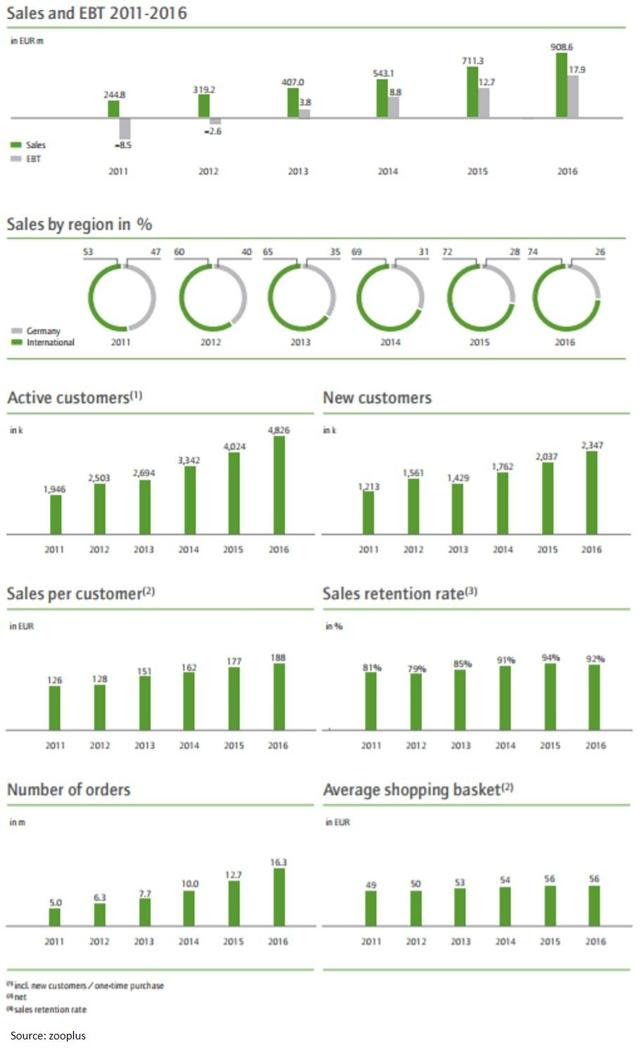

Since its foundation, Zooplus has grown to become the clear leader in online pet supplies in Europe. The company already ranks number 3 in the overall European market (bricks-and-mortar and online retailing) after Fressnapf and Pets at Home. According to the German Pet Trade and Industry Association, the European pet supplies market currently equals a total gross market volume of approximately EUR 26bn. The markets of Germany, France, the United Kingdom, Spain, the Netherlands, Italy, and Poland alone account for some EUR 21bn of this total. In 2016 annual report Zooplus put down its belief that it is today’s cost leader in the pet supply segment versus bricks-and-mortar and major online competitors. The share of products sold over the Internet in the pet supply segment is still relatively low compared to other product categories across Europe. The company’s internal estimates show that until now only around 7-8% of the total European pet market has migrated online. This means Zooplus, as the market leader, is in a unique position to benefit from these lasting shifts in the existing distribution and retailing structures.

Capacity to Suffer

Capacity to Suffer

The term “Capacity to Suffer” was popularized by Thomas Russo. He applies this phrase “Capacity to Suffer” to businesses when they choose to invest in growth which hits profits temporarily. “When you invest money to extend a business into new geographies or adjacent brands or into other areas, you typically don’t get an early return on this. That means they have to have the capacity to suffer.” The businesses willing to invest hard behind growth need management that thinks long term.

Last week Zooplus’ management announced its plans to invest more heavily in acquiring profitable new customers to achieve a sustainable acceleration in sales growth and thereby expand its leading position in the online segment. As a result, the Management Board of Zooplus AG has decided to revise its existing 2017 full-year target for earnings before taxes (EBT) from EUR 17m to EUR 22m to a single-digit million amount in order to invest in the company’s growth.

Following this announcement share price dropped more than 10%. The reaction from the market participants seems logical. The majority of investors have short-term horizon, recency bias and focusing to the day-to-day whims of the market. But what if you think long term, apply sound reasoning and play your own game. Then upfront losses should not change your view on the long-term prospect of the business. At this phase of the online pet segment development, it is not smart to stop investing because that way you are developing your competitive advantage. By having the capacity to suffer, sometimes you can build something of lasting value.

Outlook and Risks

The trend towards greater e-commerce at the expense of bricks-and-mortar retailing appears to be uninterrupted. Zooplus believes that the e-commerce market will continue to see annual double-digit percentage growth. Zooplus should continue to profit from this trend given its dominant position in the European market. Based on the current perspective, the Management Board targets for sales of at least EUR 2bn and earnings before taxes of EUR 60m in the existing customer business by 2020.

As an investor, the way I perceive investment risk is not the volatility or beta of the stock, but rather the probability of permanent loss of capital. Although there are many operational and financial risks I will focus on a few that are in my opinion the most pronounced in Zooplus’ case: (a) brick and mortar has started establishing an online presence; (b) fierce competition from both the online and bricks-and-mortar segments; (c) Amazon (NASDAQ:AMZN) presence in pet segment; (d) increase the number of retailers coming into direct competition with Zooplus; and (e) drop in customer retention rate.

To Sum Up

Zooplus benefits from several structural tailwinds, but two of them are more pronounced: (a) humanization of pets and (b) shift from offline to the online market. Despite the fact that this industry is fiercely competitive, once you establish economies of scale it is a very difficult for competitors to catch up.

It is hard to put a static price target on a company which is growing at the high rate, therefore, if Zooplus further develop its economies of scale and deliver plans, then the probability to see higher intrinsic value is on the company side.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.